Do You Need Flood Insurance?

Here are some important facts to keep in mind:

- FACT: Homeowners and renters insurance does not typically cover flood damage.

- FACT: More than 20 percent of flood claims come from properties outside high-risk flood zones.

- FACT: Flood insurance can pay regardless of whether or not there is a Presidential Disaster Declaration.

- FACT: Disaster assistance comes in two forms: a U.S. Small Business Administration loan, which must be paid back with interest, or a FEMA disaster grant, which is about $5,000 on average per household. By comparison, the average flood insurance claim is nearly $30,000 and does not have to be repaid.

In terms of insurance, “flood” is considered “ground level water from the outside in”. And only flood insurance covers water damage caused by weather and other external forces.

Flood insurance is not just for those that live in coastal areas. In fact, some 20 percent of claims through the government-run National Flood Insurance Program (NFIP) are from homeowners and renters in areas considered at low or moderate risk of flooding.

According to FEMA, just one inch of water in a home can cost more than $25,000 in damage—why risk it?

The right coverage is unique to you in Texas. To find out how to protect your family and your future in Prosper, Celina, Frisco, McKinney and the surrounding area, call Prosper Insurance Center: 972-347-5573 with the right flood insurance provided for you.

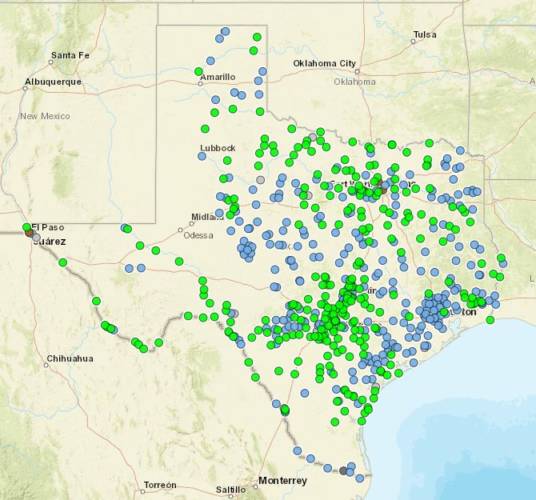

To find out if your home is in a Texas floodplain, check out the map on the Texas Flood website by clicking HERE.